Thomas Rabe, CEO of RTL Group, explains how RTL is leading consolidation in the European media industry.

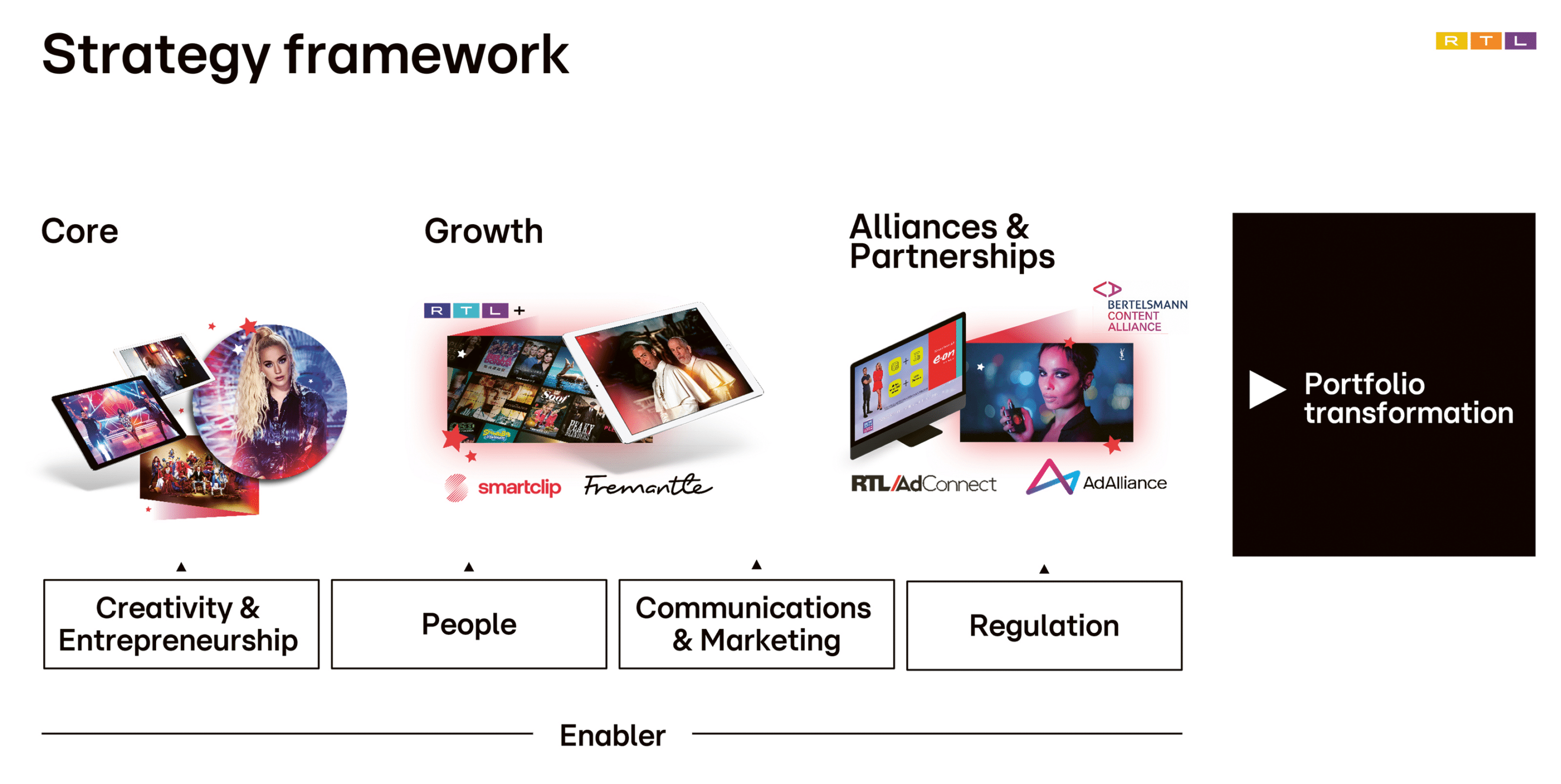

The international TV industry is in the midst of a major transformation, with big opportunities for those who are prepared to shape the future. RTL Group’s strategy is based on three priorities. Firstly, to strengthen RTL Group’s core businesses by investing in premium content, strengthening our families of channels, and focusing on cost and portfolio management and consolidation. Secondly, to expand the Group’s growth businesses, in particular streaming services, advertising technology and addressable TV and global content production from Fremantle. And finally, to foster alliances & partnerships which span from advertising sales and content production to technology and data.

RTL Group’s primary focus is on organic growth. However, whenever attractive opportunities arise, the Group is prepared to drive consolidation across its European footprint to create national cross-media champions that can compete with the global tech giants.

Core: leading the media consolidation in Europe

In May and June this year, RTL Group announced two major transactions to create national cross-media champions. Firstly, in France, with the planned combination of Groupe TF1 and Groupe M6. We expect a decision from the authorities by the end of 2022. Secondly in the Netherlands, with the planned combination of RTL Nederland and Talpa Network, where RTL Group expects a decision by the authorities in the first half of 2022.

Both these transactions have significant value creation potential with estimated synergies that are one third revenue – and two thirds cost-driven in both cases. In France, the synergy potential is €250 to €350 million – to be realised by 2025/26 and in the Netherlands €100 to €120 million – to be realised by 2025.

The strategic rationale for both transactions is scale, the pooling of resources and creativity to compete with the global tech platforms. It is about higher investments in exclusive, local content to further boost the growth of our streaming services. And it is about investments in tech and data, in particular addressable TV advertising and personalisation.

Two months later, we announced the combination of RTL Deutschland and Gruner + Jahr (G+J), following the same strategic logic. The combination is a unique opportunity for both RTL Deutschland and G+J as it creates a German cross-media champion with pro-forma 2020 revenue of €2.63 billion and operating profit of around €500 million.

The two companies combined are a journalistic powerhouse with more than 1,500 journalists. The synergy potential is around €100 million per year, to be fully realised by 2025. Three- quarters of the synergies are growth-driven. First, more exclusive and diverse content from cross-media editorial teams, for example with Geo-branded documentaries and the new TV format Stern Investigativ. Second, better cross-promotion between different media categories, for example cross-marketing for RTL Deutschland’s streaming service RTL+ to existing subscribers of G+J brands. Third, increased appeal for Germany’s top creative talents and media personalities. Fourth, optimised cross-media advertising campaigns and fifth, an overall more attractive and complementary brand and product portfolio. In June this year, we announced the sale of RTL Belgium to DPG Media and Groupe Rossel, in line with our strategy to create national cross media champions.

Growth: national streaming champions

These consolidation moves will help to boost the growth of our streaming services RTL+ in Germany and Videoland in the Netherlands. At the end of the first half of 2021, we registered more than 3 million paying sub scribers for our streaming services RTL+ and Videoland, meaning that our subscriber base grew by 72 per cent year on year. This demonstrates that our streaming investments in technology, marketing and content are starting to pay off.

HIGHER

INVESTMENTS IN

EXCLUSIVE, LOCAL CONTENT

TO FURTHER BOOST

THE GROWTH OF

OUR STREAMING

SERVICES

Growth: investing in international content production

We also have large ambitions for our global content business Fremantle. We will accelerate the expansion of Fremantle – both organically and via M&A – targeting revenue of €3 billion by 2025. This means doubling the revenue compared with 2020. Since 2012, Fremantle successfully expanded into scripted drama and established a global production network in 19 countries – organically and via acquisitions such as Wildside, Kwaï and Miso Film. This helped to significantly expand partnerships with global and national streaming services, which in this year will account for more than 15 per cent of Fremantle’s total revenue. There is a strong and growing demand for high- end factual content and documentaries, in particular from streaming services. Fremantle reacted to this demand by establishing a new global factual division, with the aim to replicate its success in scripted. First examples were Arctic Drift and documentaries about the Wirecard scandal and Angela Merkel. M&A is part of the €3 billion revenue growth plan of Fremantle – and we have been active since the beginning of the year with three acquisitions: Abot Hameiri in Israel, Eureka in the US and Australia and Nent Studios in the Nordics. Those three companies alone achieve a combined annual revenue of around €300 million.

DEVELOPMENT

HAS BEEN THE

INCREASED DEMAND

FROM ADVERTISERS

FOR GLOBAL AD-BUYING

OPPORTUNITIES

Alliances and partnerships

One key development for RTL Group’s largest revenue stream – advertising – has been the increased demand from advertisers and agencies for global ad-buying opportunities. RTL Group has continued to expand RTL AdConnect, its international sales house. With RTL AdConnect, international advertisers and agencies can benefit from seamless access to RTL Group’s large portfolio of TV, streaming and digital video services and advertising technology – all in a brandsafe environment. RTL AdConnect has a Europe-wide network which encompasses partners such as ITV in the UK, RAI in Italy and DPG Media in Belgium, in order to increase relevancy in key markets. As a result of these partnerships, RTL Group is one of the only media companies in Europe that can offer advertisers pan-European digital video campaigns.

Alongside the international RTL AdConnect, Ad Alliance is a onestop shop for crossmedia solutions and innovative advertising products in the German market. Launched in Germany in 2017, the advertising sales house spans television, radio/audio, print and digital to offer high reach to advertisers and agencies. In fact, Ad Alliance is the only sales house in Germany that can offer complex, allmedia campaigns from a single source, reaching 99 per cent of the German population.

Recent partnerships include the digital inventory from Media Impact (Axel Springer) in 2020, followed by print titles such as Bild and Welt in 2021.

The German Ad Alliance is open to additional partners, such as its counterpart in the Netherlands. Also called Ad Alliance, the integrated advertising sales network for the Dutch market combined the sales activities of RTL Nederland, BrandDeli, Adfactor and Triade Media.

Addressable TV promises to grow available inventory, attract new advertisers and deliver higher CPMs, with market studies predicting that addressable TV could account for 30 per cent to 50 per cent of all TV advertising spend in Europe in the long term. In Germany alone, the market for addressable TV advertising is expected to grow to more than €500 million by 2025.

RTL Group’s target structure

The elements I described above result in a clear target structure for RTL Group’s portfolio, with national cross-media champions in Germany, France, the Netherlands, well established cross-border cooperation in the areas of advertising sales, advertising technology, streaming technology and content development, alongside international content production from Fremantle. Within this target structure, we have ambitious growth plans to achieve by 2025: €3 billion revenue from Fremantle, €500 million revenue from streaming, and €200 million revenue from addressable TV advertising in Germany alone. This, in total, represents additional €2 billion revenue compared to 2020.

RTL – one brand, one identity

With all these changes, the time has come to reposition our core RTL brand with a new identity and a clear set of principles. With our new multicoloured logo, we combine the power of a one-brand strategy with the customisation possibilities of the digital world. Our new identity will develop the RTL brand from a traditional TV brand to a leading entertainment brand that stands for positive entertainment and independent journalism, alongside inspiration, energy, and attitude. The rebranding has started with RTL Group and RTL Deutschland, in which the rebranding of TV Now to RTL+ is part, followed by the international roll-out of the new RTL identity in 2022.