Are we heading for recession or normalisation?

The world is going through a period of huge uncertainty, and we have seen many headlines about a recession in advertising. However, if we tease apart some of the growth drivers and examine their impacts over a longer time horizon, we see instead a picture of normalisation rather than deterioration. The one counterpoint to this is the ongoing decline of linear TV, which is not expected to ever regain previous shares or levels of investment across the US and Western and Northern Europe (although there are still pockets of growth in Central and Eastern Europe, and France will see a boost from hosting the 2024 Olympics).

Normalisation is a process, and while one wouldn’t typically call current interest rates of more than 4% or 5% “normal” per se, neither was the period of near-zero and even negative interest rates Europe and the US have experienced for much of the last fifteen years. Those rates led to a period of “free money” for venture-backed companies and many of them spent heavily on advertising, sometimes upwards of 50% of total revenue in the pursuit of users and revenue growth. As rates have risen steeply over the last year, advertising intensity among this maturing group of companies has decreased and industry growth is expected to return to greater levels of correlation with nominal GDP growth.

Economic drivers such as the inflationary pressures of war in Ukraine and the Middle East are having an impact on the advertising industry. However, there are some sources of likely growth. For example, as China shifts to lower growth rates following the pandemic, an ongoing property crisis and high youth unemployment, we anticipate slow domestic demand translating to Chinese advertisers seeking revenue growth in international markets and relying in part on advertising to achieve that. Retailers such as Temu and Shein as well as manufacturers selling goods on marketplaces including Amazon and Facebook are likely to boost digital advertising in 2023 and 2024.

The trend of the decline of linear TV advertising is more pronounced in markets which traditionally had a high penetration of pay-TV households, and slower in markets with strong free-to-air consumption.

What is the role of TV / CTV?

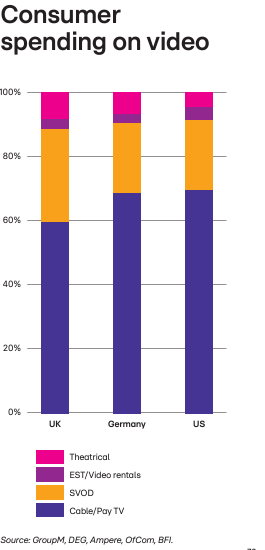

Linear TV is in structural decline, especially in the US and Western and Northern Europe. The trend is more pronounced in markets which traditionally had a high penetration of pay-TV households, and slower in markets with strong free-to-air consumption. The prevalence of both ad-supported and ad-free CTV offerings will continue, with seemingly plenty of headroom for consumers to decrease spending on pay-TV offerings and to increase spending on subscription services. In the UK, for example, 60% of consumer video spending in 2022 was on pay-TV services, with nearly 30% spent on subscription streaming services. That equates to more than £6 billion that can be reallocated as more consumers “cut the cord.” Pay-TV spending equated to 69% of spending in Germany and 70% in the US in 2022.

While some of this spending will merely shift across offerings (for example, from Sky cable to Sky Now TV, Hayu, or Peacock), a number of CTV players are growing quickly and looking to benefit from the transition away from linear TV. These include hardware companies such as Roku and Samsung, digital natives such as Netflix and even retailers like Amazon and Rakuten. As brands test offerings that match retail customer data with CTV inventory and closed-loop measurement, we are almost certain to see a greater confluence of media and commerce over the next two years and beyond.

Which sectors will drive advertising revenue in the future?

While we have seen a decline in the advertising intensity of what we call “digital endemic” advertisers – those businesses which exist primarily online (and often venture-backed as noted earlier) – they remain a key sector of advertisers alongside more traditional categories including FMCG, luxury, technology, media and entertainment, automotive and pharma.

Heading into 2024, we expect automotive advertisers to continue their recovery from pandemic-era supply chain disruptions and shortages. The influx of new electric vehicle brands from BYD to Tesla – will likely contribute to growth in this sector.

Media and entertainment advertisers, some of which may see a decrease in advertising spending in 2023 following growth greater than 20% in fiscal years 2021 and 2022, are wellpositioned heading into 2024 to lean into the experiential benefits of communal events such as live sports, and IP (intellectual property) such as the Barbie movie and the Taylor Swift Eras Tour.

How do you see the influence of AI in the advertising industry?

First, I should note that AI has been at work in advertising for more than a decade, and by the end of this year, we expect more than half of all ad revenue in 2023 will have been informed or enabled in some way by AI – incorporating machine learning, generative AI, natural language processing (NLP) and large language models (LLMs).

The most transformative aspect of this technology over the past year is “where” it is being used rather than “what” is being used. While much of the innovation around machine learning algorithms has historically taken place within large digital platforms (for example, Google, Meta, and Amazon) that had the data and compute capabilities to handle training and analysis, the simplified interface and public accessibility of tools like ChatGPT and Bard have democratised use across a much broader spectrum of advertising roles and players including on the advertiser and agency side (although GroupM, amongst others, had AI-based tools well before the release of ChatGPT-3).

With AI capabilities moving beyond the platforms themselves, we expect to see significantly more offline media and cross-platform optimisation using AI-informed decisions over the coming years.