Vincent Letang, Managing Director, Global Market Intelligence of MAGNA Global, highlights digital’s potential and TV’s decline regarding revenue streams.

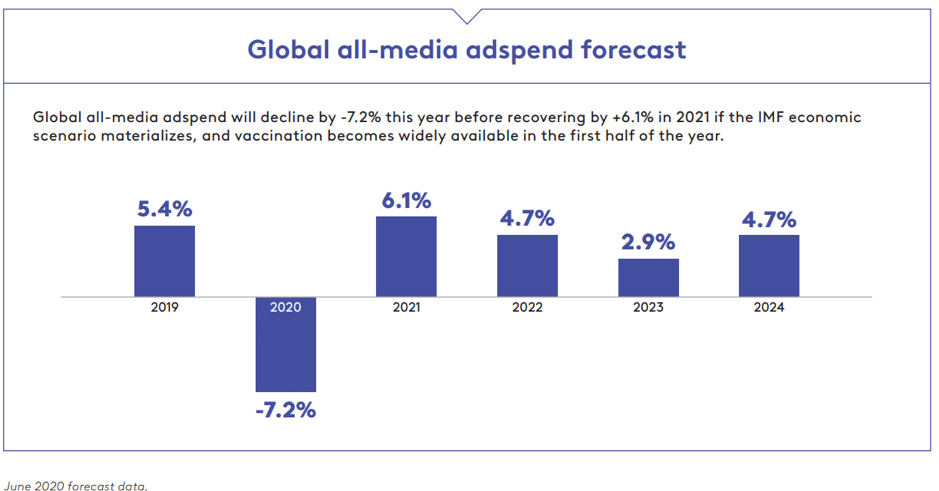

There’s no way to sweeten the pills: the International Monetary Fund (IMF) is, as I write in September 2020, forecasting a decline in GDP this year of at least 6% globally, rising to 10% or more in most European countries.

Covid and digital adspend

While there’s not a lot of good economic news right now, it’s worth noting one positive – hard to believe though it may be, things could have been worse.

The drop in demand, consumption and sales would have been much greater if not for the growth of e-commerce over the last ten years. E-commerce and online business have mitigated the impact of Covid lockdowns and supply issues, and the mere size of digital marketing and advertising today may lead to a milder drop in advertising spending than in 2008- 2009, despite a much worse economic outlook.

Another bright note is that in the US, total digital adspend was stable year-on-year in the second quarter, during the worst bout of the lockdown, as MAGNA had predicted. Search spend was slightly down, social and video up. At the time of writing, we are forecasting single-digit growth for 2020, up by between 3-5% in the US and with a 1% increase globally. We also anticipate search spend will grow again and remain stable on a full-year basis, as sponsored product listings are boosted by the expansion of e-commerce in terms of volume and number of businesses involved.

Linear adspend suffers more

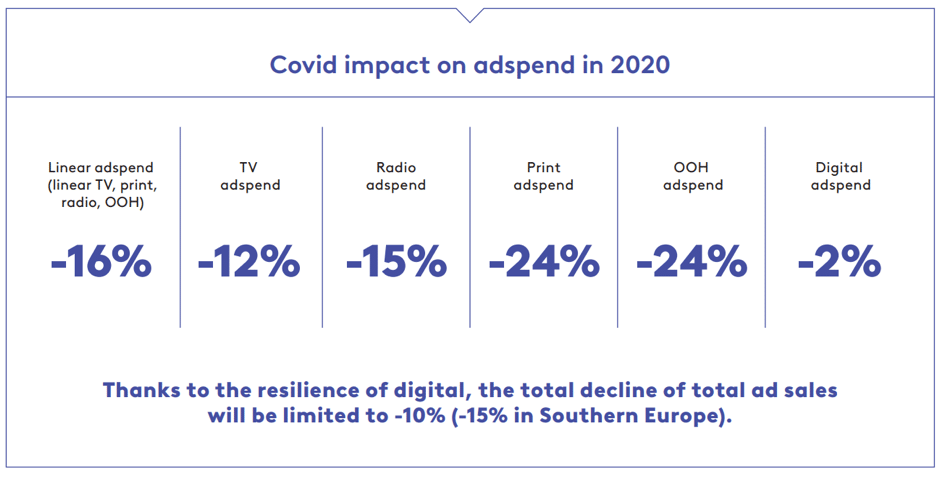

When it comes to adspend on linear TV, print, radio and OOH, put bluntly, the declines this year are heavy: at the time of writing, MAGNA is forecasting a 16% decline globally on average, and it could be down as much as 20% in many markets. TV will fare somewhat better, with a forecast decline of 12% on average, compared with 15% for radio, and 24% for both print and OOH.

The forecast is slightly worse for Western Europe with TV and radio down 16%. Digital will be more resilient (-2%), limiting the total decline of total ad sales to -10% (-15% in Southern Europe).

That said, ad dollars are not moving out of media. If we include all digital advertising formats within “media”, MAGNA suspects media is gaining market share over other marketing mechanisms such as direct mail, promotion and – of course – trade events and in-store marketing.

What to expect in the next 12 months

Looking at 2021, assuming the availability of a Covid vaccine and no return to large-scale lockdowns, the IMF is expecting the global economy to grow again, but only by between 3-6% – not enough to offset the deep GDP contraction of 2020.

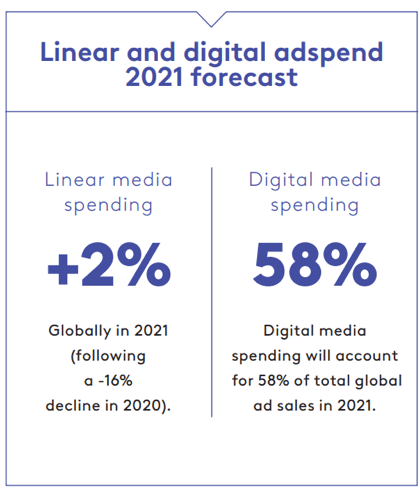

Marketing activity will recover too, helped by a return to normal sports events, TV programmes and movie releases, especially as a number of 2020 events have been rescheduled, like the Tokyo Olympics, UEFA Euro or the World Fair in Dubai. Even so, MAGNA does not expect a massive rebound for linear media next year. Instead, we’re forecasting a stabilisation, with a 2% global rise (following a -16% decline this year). Meanwhile digital media spending will re-accelerate by +10%, accounting for 58% of total global ad sales in 2021.

Discrepancies across world regions

In Europe and Asia, the Covid lockdown triggered a massive increase in TV viewing and ratings that reached +30% vs 2019 (against a normal pattern of -5% to -10% per year in the last three years) and lasted for months. In North America, the surge was milder (+10%) and faded away by end of May. We see two main reasons behind that difference.

First, North America is ahead of the curve in the transition to streaming, OTT and on-demand video consumption, with higher penetration than Europe. As the lockdown coincided with the launch of several new attractive SVOD services (Disney+, Peacock, HBO Max etc), streaming benefitted the most from the rise of video consumption in the US. In Europe the rise in SVOD or AVOD consumption was even more impressive in year-on-year terms (doubling in some markets) but from a lower base, so that it didn’t cannibalise linear TV viewing.

Second factor: the prominence of live sports in North America’s TV schedule on free networks and basic cable networks, while major league sports are often on premium pay channels in Europe. The cancellation of college basketball in March, NBA and NHL playoffs in Q2, just to mention three big events, mechanically hit linear viewing in the US.

What’s next for OTT and linear TV viewing

Over-the-top consumption of television content is expanding quickly. Right now, it is mostly subscription-based but AVOD and linear TV viewing are developing too. Penetration of connected TVs and relaxation of local regulations will allow broadcasters and agencies to target OTT viewers at scale and more efficiently in coming years. Addressable TV campaigns will thus become increasingly attractive and cost effective.

Beyond 2021

An economic recession in 2020 or 2021 was always a distinct possibility, given the exceptional length of the uninterrupted growth cycle in America (10 years), the slowdown of 2019 and the classic downturn factors (housing and stock bubbles, international crises, trade war). In the end the downturn was triggered by a Black Swan.

The Covid-induced recession is deeper than any past recession, broader geographically (e.g. China’s economy barely slowed down during the 2008-2009 global recession) and different because it doesn’t just affect demand, it affect supply.

Some industries (travel, automotive, movie theaters…) have been utterly devastated by the pandemic in the short term and have seen their very business models get upended in lasting ways, as lifestyles and consumption patterns are not expected to go back to pre-Covid normal.

Some argue this makes forecasting impossible but at MAGNA we disagree. It is still possible to predict marketing and advertising spending based on the laws of supply and demand (1) AD DEMAND: firms big and small adjust marketing and advertising budgets to current and expected revenues in each industry vertical; (2) AD SUPPLY: media channel performance (market share) in the mid and long term is driven by media consumption trends.

Demand, as in when and how advertisers’ demand will recover, is harder to predict this time because of the uncertainty on a vaccination timeline and the halo effect on consumer behaviour. Supply analysis is somewhat easier as Covid has not altered, just accelerated pre-existing media consumption trends towards digital and on-demand media.

Consequently, MAGNA has adjusted its long-term scenario following Covid, to take into account long-term changes to lifestyles, consumption and media consumption (e-commerce, mobility, savings, digital media).

Even when economic activity expands again, it’s not likely to translate into marketing/advertising spending growth as much as it used to in the 2010s. For that reason, MAGNA has reduced its global advertising growth forecast by 0.5% to 1%, compared to the pre-COVID scenario, for each of the years 2022, 2023 and 2024.

its global advertising

growth forecast by 0.5% to 1%,

compared to the pre-COVID scenario,

for each of the

years 2022, 2023 and 2024.

It’s a tough time, but this recession has another difference. Instead of hitting all sectors in similar terms, it’s generating winners and losers.

Television, with the expansion of over-the-top consumption, the rise of connected TV penetration and relaxation of local regulations, could be in a position to do well. To date, the industry has proven itself to be resilient and adaptable; let’s see how it emerges from this next wave of change.