In an increasingly fragmented advertising market where advertisers are also seeking to keep investments down, it is essential for the media landscape to continue adapting to fast changing demands. The desire for automated processes available to all and broadcaster-led solutions are set to drive this year’s trends. Here are some of our expectations.

The growth of programmatic video buying

We expect that 2021 will see programmatic become the standard for all video buying, especially for premium content. This entails the gradual shift from IO campaigns, a direct and manual deal between a publisher and an advertiser, to programmatic, resulting in the general slow-down of IO for video campaigns.

We believe that the number of Programmatic Guaranteed deals (PG) will grow against PMP’s (floor price), which gives buyers more security with a delivered fixed price and volume at the end of the campaign. In 2021, more European Premium Publishers are recognising the advantages of PG and are proposing this type of deal in their standard sales conditions.

The democratisation of video buying

In recent years, there has been an increase of publishers’ own buying platforms, which allow advertisers to buy faster, with less friction and with exclusive access to inventory and data not available via any other sort of DSP.

Last year, for example, ITV launched Planet V. This simplified access to digital video inventory means that video buying is no longer only the remit of the expert programmatic buyer but of many more. We expect more and more initiatives to be launched in 2021, in a bid to reduce tech tax and eliminate fraud but also to facilitate access to BVOD (Broadcaster Video on Demand), OLV (Online Video) and Linear TV to experts and non-experts alike.

Moreover, we will see also a growing number of direct buying relationships between advertisers and publishers, supported by these new initiatives.

The enhancement of broadcaster data

With the decision from major browsers to dispense with third party cookies due to concerns around GDPR compliance, we think that there will be an increased demand for premium publishers’ first party data. Broadcasters are therefore set to launch more initiatives that will account for this demand. Their first step will be to collect qualitative data from catch-up platforms users like the login compulsory on the majority of all of RTL Group’s platforms or to collect data from a single login ID, like the German Net ID initiative did, which allows the user to access different Publishers’ platforms.

Their second step will be to improve access to this premium 1st party data. In France, M6, in partnership with their main competitors, launched the SYGMA initiative which values DSP buying tools to provide 1st party data from all their platforms and websites to advertisers. New publisher buying platforms, like Planet V mentioned above or D-Force in Germany, will also give safer and faster access to broadcasters’ first party data.

Broadcasters may also seek to continue their data partnership with retailers, like French group M6 has done with digital marketing player RelevanC, to enable advanced targeting solutions to advertisers in the retail sector.

The further development of the OTT offer & CTV consumption in Europe

Consumption of video on Connected TV is rising and digital advertising on the big screen will continue to increase as well. We therefore assume that CTV providers will address concerns like ad Fraud and measurement, and improve clarity surrounding CTV so that advertisers can harness the power of a larger screen to target audiences. IAB has already launched a global European initiative to clarify CTV opportunities for advertisers.

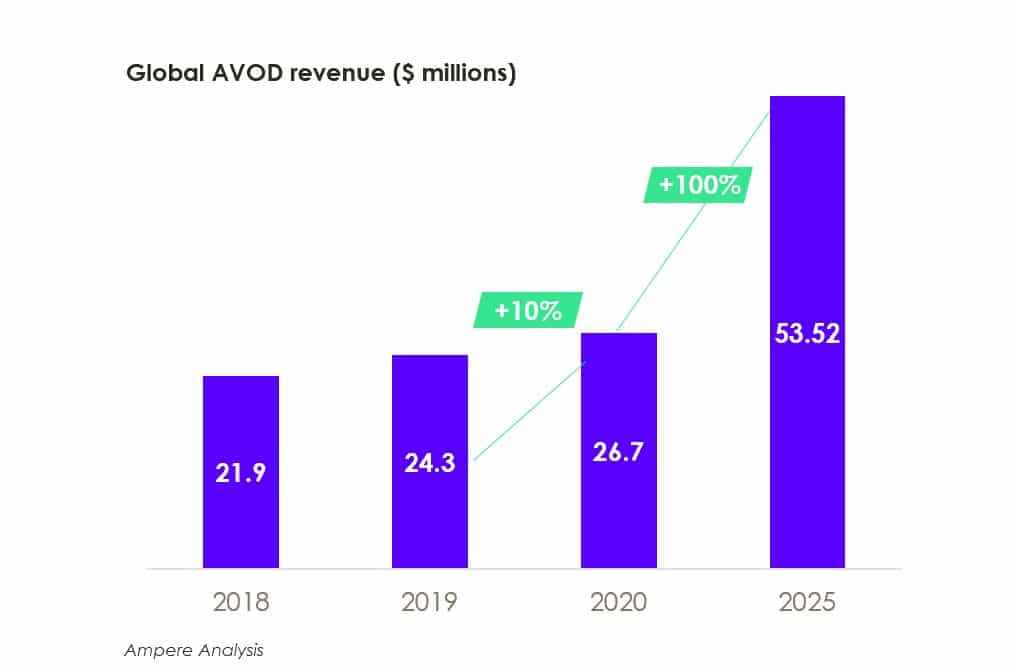

With the increased use of CTVs, the number of online video platforms is increasing drastically too, which will fragment the market even more. This will reduce users desire to subscribe to too many SVOD services. We expect, it will lead to the increased uptake of ad-supported VOD services, which in turn will see more platforms created. Revenues are therefore believed to double between 2020 and 2025 with providers expected to concentrate on pan-European offerings, such as those from RakutenTV, Pluto.tv and Roku.

The consolidation of new advertising formats

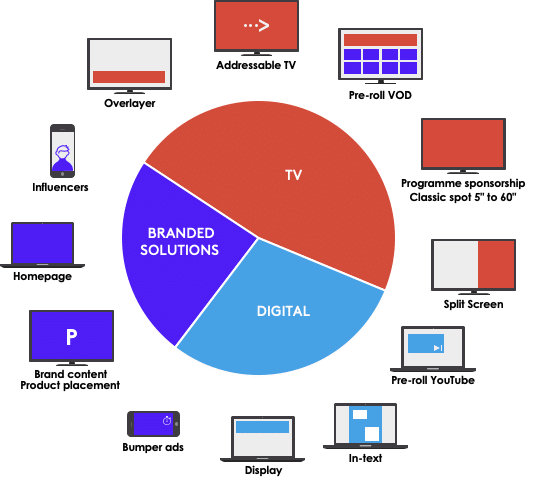

In 2021, we believe that Addressable TV availability, supported by the growth of CTV, as well as the number of campaigns run, will grow significantly due to the increased understanding of ATV’s role in campaigns across every video touchpoint and of its high ROI. We also expect to see the launch of ad replacement in France and then subsequently in other countries if successful.

Away from video, we believe there to be interest in programmatic buying for audio. Digital audio consumption has been on the rise in recent years, which reflects Amazon’s purchase of ‘Wondery’ (the 4th best platform to produce exclusive podcasts) and the creation of a common digital platform that contains all their live and podcast content.

We also anticipate that more innovative formats integrating more interactivity in linear signal like QR codes in ads and audio watermarking will become more commonplace.

As the world continues to evolve under the unprecedented conditions that the pandemic has created, simplified, automated access to digital inventory, first-party data solutions and innovative, trustworthy broadcaster solutions are expected to dominate the market this year and it is essential for the industry to continue adapting with it.