The living room played an ever-more important role in our lives during the pandemic as TV viewing soared. Daniel Bischoff, CMOO at RTL AdConnect, shares his view on the way in which the living room gained a new lease of life.

The living room, once a place of relaxation and household gatherings, has been totally transformed by the pandemic. Now it’s become a location for work, leisure, fitness classes, child-care and homework, a space for joy, for arguments and for sweat.

As the living room has emerged as the central hub for the activities of modern life, households have reorganised their nests. The front room has had a makeover with the addition of new sofas, desks, lamps and, of course, the latest TV sets. Lounges have been spruced up with rounds of redecorating. And Smart TVs are now to be found in seven out of ten US homes, according to a study by Hub Entertainment Research.

Understanding these changes is essential for advertisers as they seek to engage with people in their home environments. The living room has evolved into a highway for advertisers to connect with European consumers.

Above all, the living room has been a place of media consumption, whether Zoom or Teams meetings on laptops, video games on consoles, music through the new breed of Bluetooth speakers or right at the centre of the living room experience, the TV set.

New trends in media were forged in the newly-refurbished living room of 2020 and these will resonate across the advertising landscape for years to come. TV has reclaimed its central role in our communal lives.

Shared TV viewing increased by 30% during the UK’s first lockdown according to data from BARB. Solo viewing also increased during this period, but at a lower rate of 13%. The trend towards greater collective viewing has brought families and friends together and established new rituals in front of the TV.

THESE CHANGES

IS ESSENTIAL FOR

ADVERTISERS AS

THEY SEEK TO

ENGAGE WITH

PEOPLE IN THEIR

HOME ENVIRONMENT

The biggest screen in the home just got bigger. The TV has once again become the anchor for family entertainment and co-viewing. This has triggered increased spending not only on the hardware as people have bought ever -wider screen TVs, but also on content as viewers have spent more time watching streaming services. Meanwhile, the time spent watching video in the UK increased from 4 hours 15 minutes a day before the first lockdown to 4 hours 51 minutes after, driven by increases in online video and watching subscription streaming services.

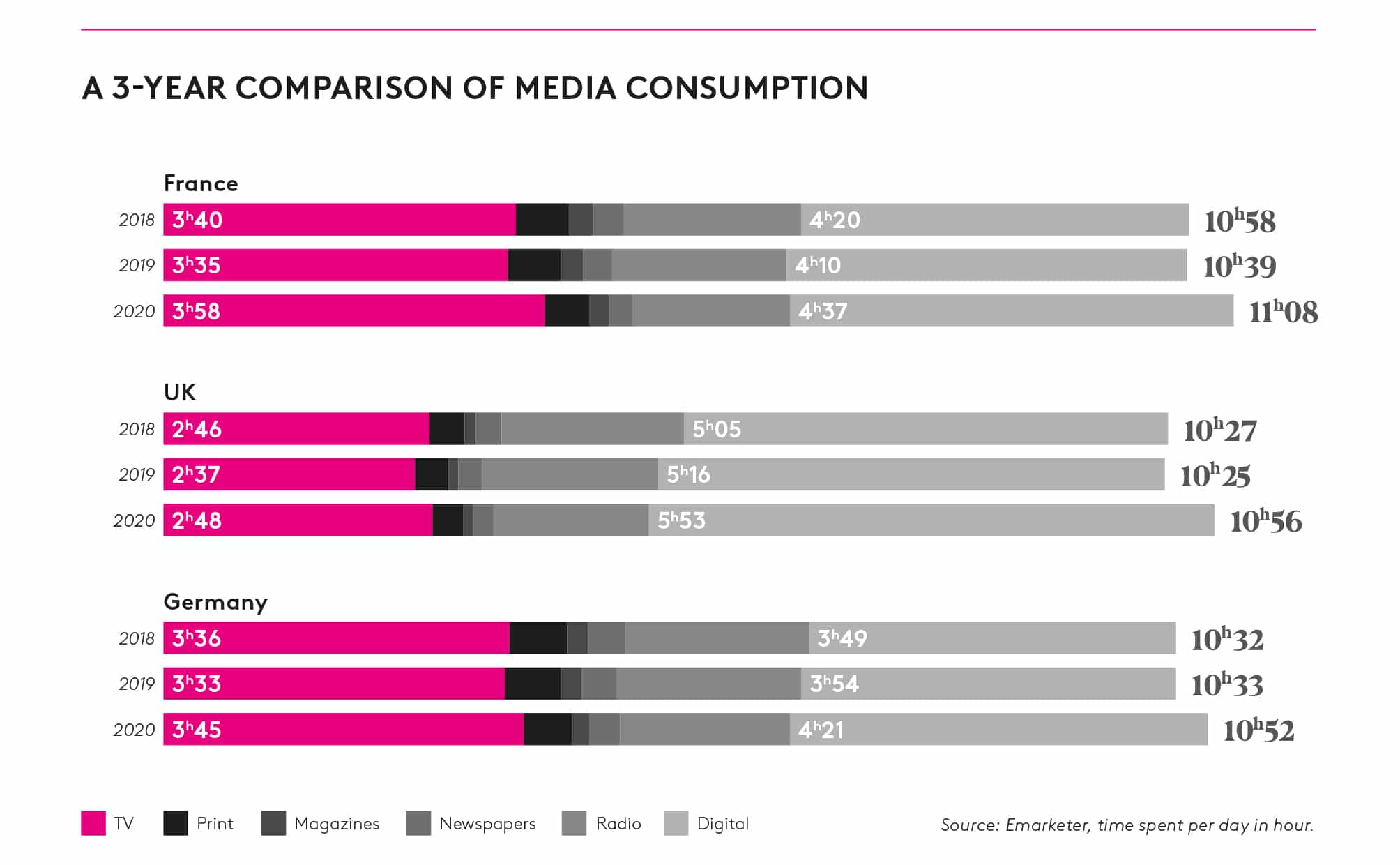

During 2020, the thirst for escapism and distraction helped every form of broadcast TV – live, on-demand, and playback. The average person watched 3 hours, 55 minutes of linear TV a day in Europe. But there were shifts in consumption related to the pandemic – in the UK, news watching jumped by 33% and weekday daytime viewing soared by 16%[1].

Subscription channels also grew, with time spent viewing rising by 12 minutes per person per day, a 50% rise year on year. The average person watched 36 minutes of SVOD a day[2].

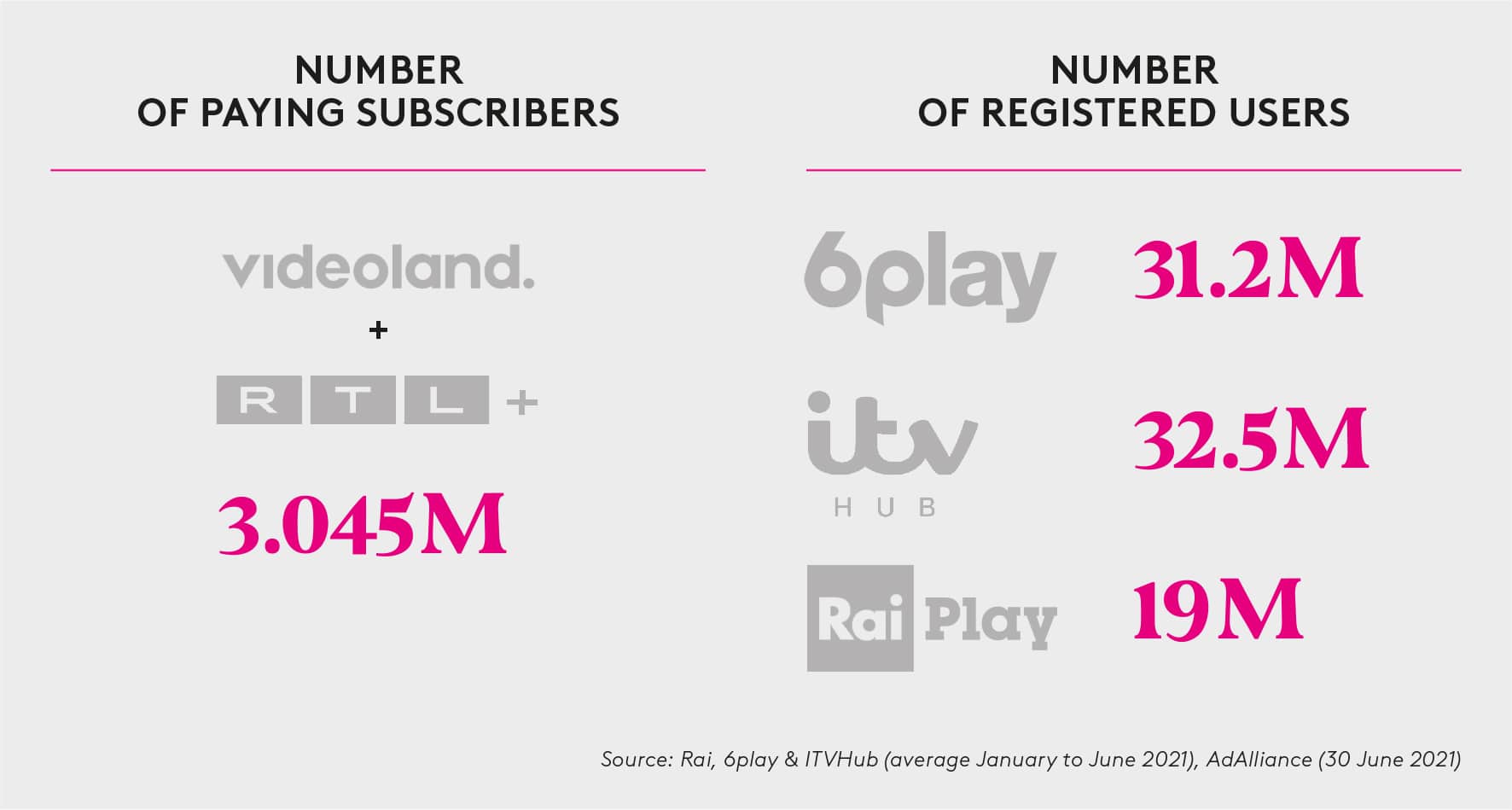

Viewers continued to sign up to the big global streaming services to watch international content. But interestingly, these services did less well than expected. More consumers signed up for nation-based subscription services as they sought out programming with locally-produced content, whether matchmaking shows or dramas in their own languages. 6Play, the BVOD platform of Groupe M6 in France, reached 31.2 million registered users in June 2021, ITVHub in the UK attained 32.5 million and RaiPlay in Italy 19 million. On the 30th of June 2021, RTL Group recorded 3.045 million paying subscribers for its streaming services RTL+ (formerly TV Now) in Germany and Videoland in the Netherlands – 72% more than in the same period last year. The viewing times of RTL+ and Videoland also increased in the first half of 2021, by 51% and 12% respectively.

A significant change in 2020 was the rise in the number of TVs connected to the internet – in the EU, this hit the 50% mark for the first time. This gives viewers a wealth of new content to watch and also opens up opportunities for advertisers to make use of more options.

In Germany, 70% of TVs were connected in 2020, while in the UK the figure was 63.2%.

There are many ways to connect a TV to the internet – through gaming consoles, dongles, set top boxes or through a smart TV with an internet connection built in. The pandemic became a learning experience for viewers as they developed their knowledge about the wide array of gadgets and connections that could plug into the TV set allowing access to digital content. Some used dongles for the first time, others started hooking up their laptops to the TV to access online content through the big screen. Their kids may have shown them how versatile their games consoles were.

Another big change that the renaissance of the living room brought could be observed in the US, where TV leap-frogged mobile devices as the screen for watching video. Mobile video viewing rose by an estimated five minutes to 62 minutes a day after the pandemic, while TV viewing rose by 22 minutes to 63 minutes a day.

For advertisers, these trends have huge implications. Before the pandemic, brands thought that TV would gently decline so they put more effort into developing their strategies for mobile, digital, and social media. But with the rebirth of the living room and the giant TV screen at its centre, they must review their strategies. TV today is expanding beyond the linear signal and is offering more engaging content than ever. Consumers are eager to tune in to locally produced, high quality content that relates to their cultural reality. This huge trend towards non-linear viewing on the big screen means brands need to boost their presence on catch-up channels that capture best the consumer attention.

BOOST THEIR

PRESENCE ON

CATCH-UP CHANNELS

THAT BEST CAPTURE

CONSUMER ATTENTION

Increased connectivity of TVs has also boosted Addressable TV, allowing advertisers to target individual households through a combination of the high reach linear TV signal and a digital return path.

The big task for the years ahead is to create a measurement framework that will be able to fully grasp and show the true power of cross-screen and cross-media consumption in the living room.

The rebirth of the living room requires brands to rethink their media strategies, to restart connecting to European consumers by recapturing the media consumption in the living room.